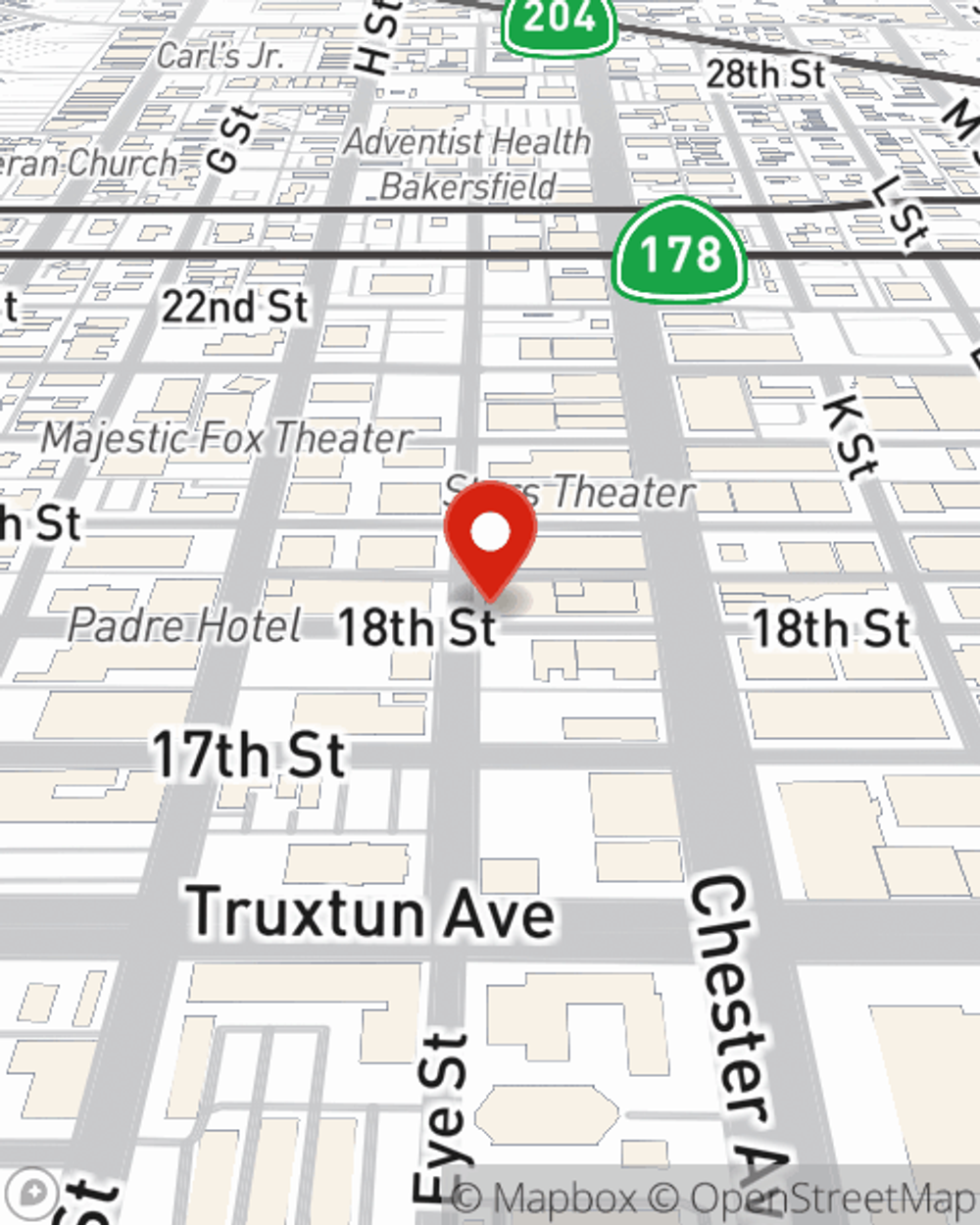

Condo Insurance in and around Bakersfield

Looking for great condo unitowners insurance in Bakersfield?

State Farm can help you with condo insurance

Home Is Where Your Condo Is

Stepping into condo ownership is an exciting decision. You need to consider needed repairs your future needs and more. But once you find the perfect condo to call home, you also need terrific insurance. Finding the right coverage can help your Bakersfield unit be a sweet place to call home!

Looking for great condo unitowners insurance in Bakersfield?

State Farm can help you with condo insurance

Why Condo Owners In Bakersfield Choose State Farm

You’ll get that and more with State Farm Condo Unitowners Insurance. State Farm has terrific options to keep your largest asset protected. You’ll get coverage options to accommodate your specific needs. Fortunately you won’t have to figure that out on your own. With empathy and terrific customer service, Agent Jasmin Samano can walk you through every step to help generate a plan that protects your condo unit and everything you’ve invested in.

Finding the right insurance for your unit is made simple with State Farm. There is no better time than today to get in touch with agent Jasmin Samano and check out more about your fantastic options.

Have More Questions About Condo Unitowners Insurance?

Call Jasmin at (661) 872-5140 or visit our FAQ page.

Simple Insights®

Condo insurance basics

Condo insurance basics

Condo insurance coverage works in tandem with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Jasmin Samano

State Farm® Insurance AgentSimple Insights®

Condo insurance basics

Condo insurance basics

Condo insurance coverage works in tandem with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.